Factur-X/ZUGFeRD

France and Germany have developed a different approach to e-invoicing with their respective standards Factur-X and ZUGFeRD. Beginning with version 2.1, the two standards are now identical.

PDF Attachments

While the pure XML formats UBL and CII can optionally embed a PDF version of an invoice, Factur-X/ZUGFeRD goes the opposite way. They are special PDFs with a machine-readable XML version of the invoice added to the PDF as an attachment.

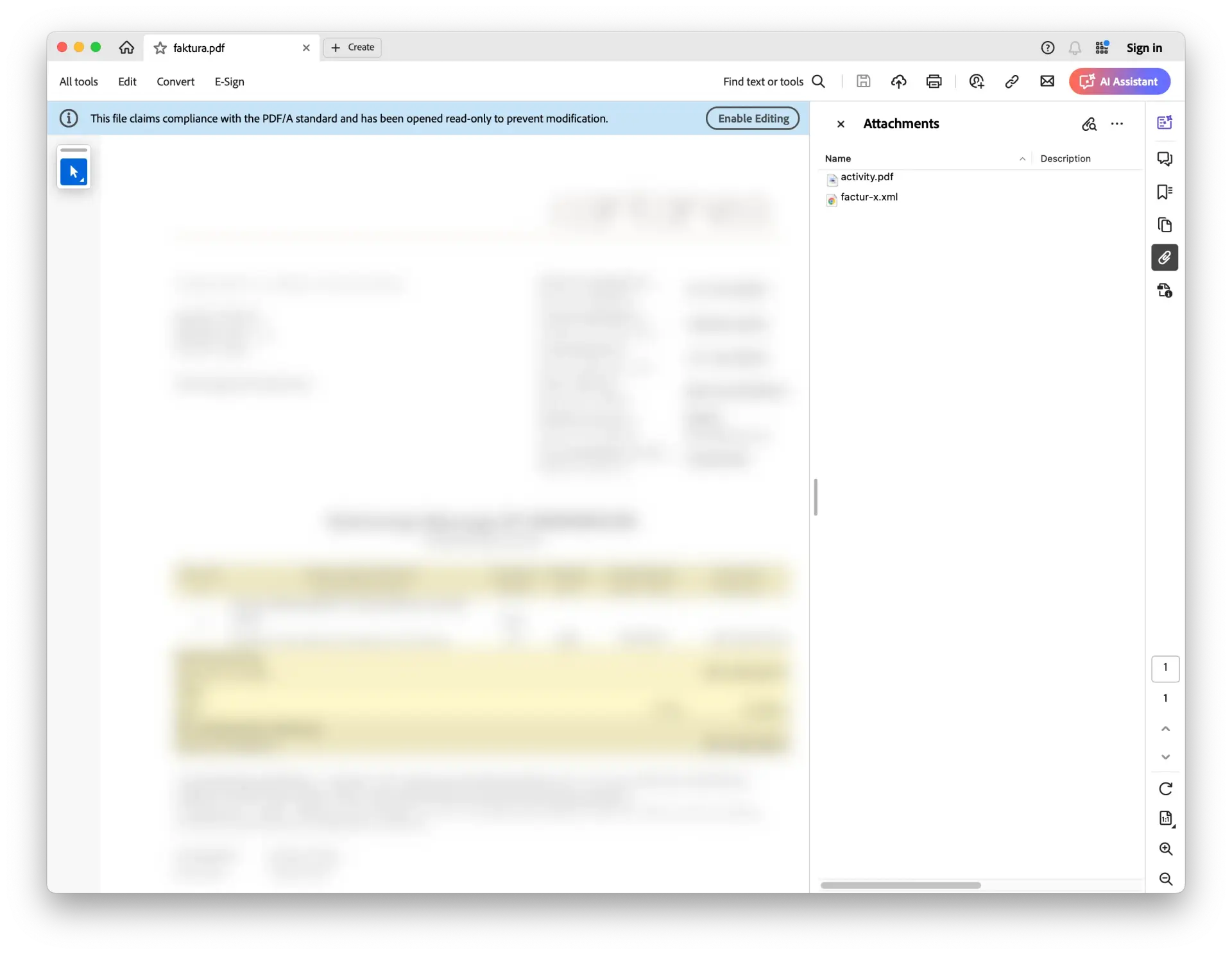

The ability to attach arbitrary documents to a PDF is one of the lesser known features of the Portable Document Format PDF and most PDF viewers do not allow you to see attachments to PDFs. However, Adobe Acrobat Reader has this feature.

The functionality is hidden behind a paperclip icon at the right side of the window. Clicking it reveals the list of attachments to the document. In this case, not only the XML invoice file but an additional file for informational purposes is attached, too.

CII is Mandatory for Factur-X/ZUGFeRD

Unfortunately, Factur-X/ZUGFeRD does not leave a choice between UBL and CII. CII is the mandatory syntax for the embedded XML.

PDF/A

But even with the attached XML file, a PDF does not automatically qualify as a valid electronic invoice. A PDF file may look different on different devices. For example it may not embed all fonts used but reference a font that is expected to be installed on the particular device. If the font is missing, a replacement font is chosen by the renderer.

If a PDF fulfills the PDF/A standard, all fonts must be embedded and also a couple of other requirements have to be fulfilled so that it is guaranteed that the PDF will look exactly the same on every device, even in the future, so that the documents are revision-safe.

Validating Factur-X/ZUGFeRD Invoices therefore involves two steps. First, compliance with the PDF/A standard is checked. Second, the attached XML undergoes the normal checks as pure XML documents.

In fact, a third check is required. PDFs contain meta information in the Extensible Metadata Platform XMP format, and that meta data has to contain certain extra information for Factur-X/ZUGFeRD.

Profiles (Conformance Levels)

The standard allows for 6 different conformance levels called profiles:

- Minimum

- Basic WL

- Basic

- EN 16931 (formerly known as Comfort)

- Extended

- XRechnung

Each profile restricts the number of allowed CII elements to a certain subset. "Minimum" is the smallest subset and "Extended" the largest. The profile "XRechnung" seems to allow the full range of CII elements although the documentation is not clear about that.

The profiles "Minimum" and "Basic WL" do not contain enough information for a valid invoice according to VAT legislation but are considered accounting aids.

When a data format allows optional information, the common approach in the software industry is to recommend that readers of the data should simply ignore those parts that are not relevant for a particular application. The strategy chosen by Factur-X/ZUGFeRD, however, makes things unnecessarily complicated.

Discrepancies Between PDF and XML

Factur-X/ZUGFeRD invoices look like regular PDFs and recipients may not even know that the documents contain an XML version of it. The German ministry of Finance stipulates that the PDF and XML versions must be content-identical counterparts (German: inhaltsgleiche Mehrstücke). It is still unclear how courts will assess any discrepancies between the two versions.

Documentation

You can download the documentation for Factur-X from https://fnfe-mpe.org/factur-x/factur-x_en/. The docs for the German counterpart ZUGFeRD are available from https://www.ferd-net.de/. You have to enter a valid e-mail address in order to be able to download the documentation. The exact links frequently change but can easily be found with a search engine.

Although Factur-X and ZUGFeRD are now identical standards, there is both a

French and German version of the documentation with different structure. The structure of the

documentation fundamentally changes with every release and occasionally even

contains garbage like .DS_Store files from the Mac where stuff

has been zipped.